McLaughlin & Stern's tax group provides advice and assistance regarding international, federal, state and local income, estate, gift and other taxes, in commercial, individual, not-for-profit and estate contexts. Firm clients range from large multinational corporations to individuals and families, many of whom reside or have interests outside the United States.

The firm's tax group works closely with clients to devise tax-efficient structures and strategies in the context of business transactions, personal financial planning, charitable activities, executive compensation arrangements and formulating settlements of civil litigations. The firm has often focused on the particular tax problems of persons involved in the creative and performing arts. In view of the global nature of the firm's practice, many of the issues addressed involve international tax considerations.

McLaughlin & Stern also maintains a vigorous tax controversy practice and represent clients in administrative forums as well as in the courts.

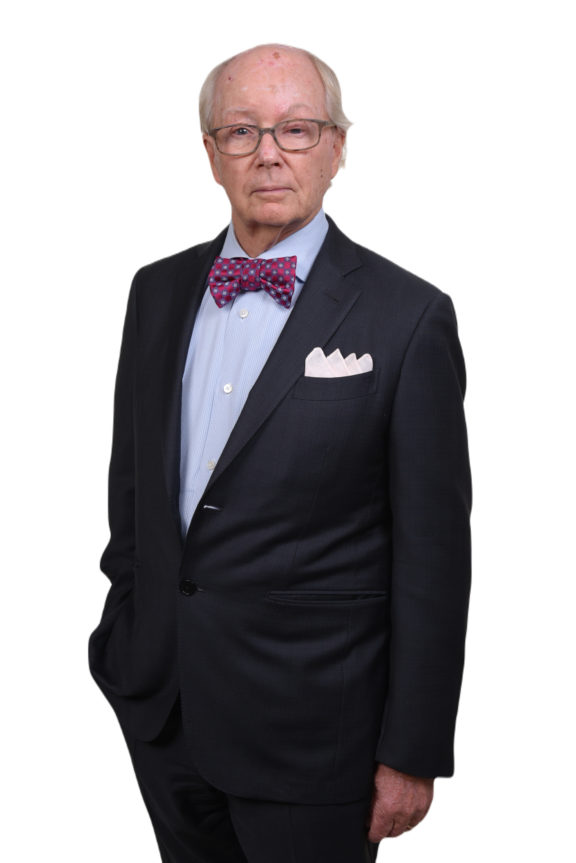

PRACTICE AREA CHAIR

RELATED PRACTICES

RELATED NEWS & PRESS

Artist Says Law School Hiding Murals Will Hurt His Reputation - Law360 Law360 (March 7, 2022, 3:27 PM EST) -- The decision by the Vermont Law…

Share ThisRELATED ATTORNEYS

Walter W. Regel 212-448-1100 New York, NY vCard

Lee A. Snow 212-448-1100 New York, NY vCard

Stephen J. Krass 212-448-1100 New York, NY vCard

John P. Barrie (212) 448-1100 New York, NY vCard

Timothy S. Feltham 212-448-1100 New York, NY vCard

Geoffry R. Handler 212-448-6200 New York, NY vCard

T. Randolph Harris 212-448-6272 New York, NY vCard

James M. Kosakow 212-448-6212 New York, NY vCard

Hollis F. Russell 917-612-0758 New York, NY vCard

Stuart Schnaier 212-448-6246 New York, NY vCard

Steven E. Plotnick 212-455-0441 New York, NY vCard

David W. Sass 212-448-6215 New York, NY vCard

Barbara A. Sloan 212-448-6229 New York, NY vCard

David R. Stack 212-448-6270 New York, NY vCard

Karen Streisfeld-Leitner 212-803-1311 New York, NY vCard

Dennis Wiley (516) 829-6900 Garden City, NY vCard

Leslie A. Wilson 212-448-1100 New York, NY vCard